GENERAL DATA

Located in southwestern Europe and comprises about 84 percent of the Iberian Peninsula, 88 % is water and 12 % land.

The Cantabrian Sea (Bay of Biscay) is to the north, the Mediterranean Sea and the Balearic Sea to the south-southeast, Portugal and the North Atlantic Ocean to the west, and France and Andorra to the northeast along the Pyrenees Mountains.

- There are a growing number of women entering the medical and legal professions. Women take an active role in politics.

- The public sector in health care is the largest and continues to grow. There are 354 public hospitals, 149 private hospitals, and 312 private business hospitals.

- Passports are required to enter Spain. Citizens of many countries, including the United States, may stay up to 90 days without a visa.

- In 2005, the US Department of State estimated the daily cost of staying in Madrid at $330; in Barcelona, $367; and other areas, $262.

FOREIGN INVESTMENT: Investing in Spain

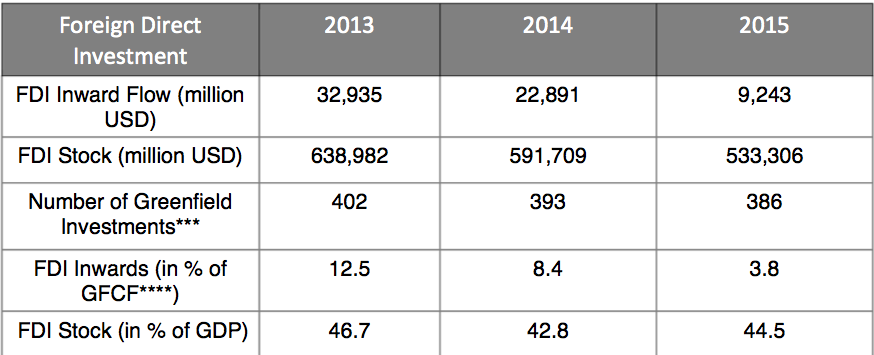

Spain is the fifth largest recipient of FDI stock and the sixth largest investor in the European Union (CNUCED, 2016).

After FDI dried up due to the crisis in the Eurozone, FDI to Spain have recovered thanks to the country becoming more competitive and to the increased confidence of investors.

During the first two quarters of 2016, FDI declined by more than 29% compared to the same period in 2015, reaching EUR 6.7 billion. After an exceptional year 2015, this represents a return to the average levels observed before.

In terms of FDI appeal, the country’s strengths include: cultural proximity to Latin America, with the presence of a number of Spanish multinational companies, the boom in tourism, its highly efficient transport network and its development of renewable energies.

The state aspires to become one of the world’s key research actors. To this end, it has developed the ‘Malaga Valley’ project, whose promoters are hoping to construct the largest European research and innovation centre dedicated to information and communications technologies (ICT).

INCOME TAX

Personal Income tax in Spain, known as IRPF was introduced in 1900. It represents nearly 38% of government revenues.

Since 2007, the responsibility for regulating and collecting personal income tax has been decentralized, the autonomous regions being responsible for collecting 50% of tax revenue.

A single national rate applies per taxation band for the whole national portion of the income tax. Tax rates on the regional portion vary between regions, Madrid having the lowest and Catalonia the highest.

Tax is withheld by the employer monthly on behalf of the tax authority. Tax returns are submitted between April and June of the following year and refunds are normally paid between May and July.

However, the Government has until the end of the year to liquidate before the tax payer has a right to interest for the outstanding money: any payments not paid by this date are paid with interest from the beginning of the next year.

Income tax is payable by both residents and non-residents with different rates applying.

Individual residents are liable to Personal Income Tax (IRPF) in respect of their worldwide income.

Non-residents are liable to IRPF only on their Spanish sourced income. Residence status must be established when filing a Spanish tax return and has consequences for the amount of tax due.

Spain considers any alien to be resident if they were living in Spain for more than 183 days in the tax year. Sporadic periods of time outside of Spain are not counted towards establishing oneself as non-resident for tax purposes.

An alien is also considered resident if s/he has a spouse or underage child who are residents, as well as any alien who has their main economic centre in Spain. When there is a residence conflict double taxation agreement must be checked.

ALLOWANCES AND DEDUCTIONS

Some amounts are subtracted from the income tax base before the rate is applied.

Allowances are adjusted annually by law and vary depending on whether the income is from labor, the tax payer is single or lives with elderly relatives or dependants, challenge conditions of the tax payer or those they live with and other issues.

The amount may be reduced by declaring income with your spouse if you are married and some expenditures (like contributions to unions, personal pension funds, etc.). Figures given below are valid for the single year 2014.

Personal tax allowance differs depending on age. For under 65s the personal tax allowance is €5,151. Individuals aged between 65 and 75 are allowed a €6,069 personal allowance. Anyone above 75 receives the highest personal allowance at €7,191.

There is an elderly relative allowance which lowers the taxable income and applies to those tax payers who live with relatives older than 65 (or with relatives of any age with a disability graded at 33% or more) who do not have income themselves. This allowance is €918 if the relative is aged up to 75 and €2,040 above the age of 75.

A dependants allowance which also lowers the taxable income base applies to tax payers who live with dependants younger than 25 (or with dependants of any age with a disability graded at 33% or more).

For the 1st dependant, the allowance is €1,836. The allowance for the 2nd child is €2,040. For the 3rd child the allowance is €3,672 and each further child has a €4,182 allowance. In addition, there is a maternity allowance which is €1,200 for each child under the age of 3.

There are also other reductions and deductions applicable for expenditures and housing.

Some autonomous communities (like Cantabria, Castilla-La Mancha and Madrid) have different allowances for their own share of the income tax and also establish their own deductions.

CURRENT RATE

Once the gross income has been reduced by the legal allowances, reductions and deductions, the tax payer has to apply the rate to find out the actual tax.

As of January 1, 2015, the income tax has been reformed and simplified. It’s important to note that these rates vary between each region. The rates shown below apply to the Community of Madrid.

Andalusia and Catalonia apply a higher regional income tax than Madrid. The top rate of income tax in Andalusia and Catalonia is 49%.

If you are interested into investing in Spain, please send us an email with your request. We will get you in touch with our members operating there.