Economic Overview

Latvia at present appreciates solid monetary development and it has embraced various changes in key regions. Latvia’s economy is on general solid balance with strong profitability development, however fast wage development conveys a few dangers. Latvia has executed a noteworthy duty change and is seeking after changes in other key zones like human services, instruction and open organization.

While these changes expect to address a portion of the key difficulties distinguished in this report, their adequacy shifts. In the meantime, the quickly contracting populace is weighing vigorously on work supply and the effectiveness of open administrations. In addition, the high disparity and various social difficulties mirror the frail social security in Latvia.

An enhancing outer standpoint combined with recuperating speculation has driven Latvia’s genuine GDP development over 4% of every 2017. Genuine GDP development is conjecture to have achieved 4.5 %, twofold the 2016 figure and the most elevated GDP development since 2011 because of the recuperation of ventures, the more good outer standpoint and proceeded with solid private utilization development.

Development is required to dial down to 3.5% out of 2018 and 3.2% of every 2019 once the underlying lift from the speculation recuperation has passed. Fares and private utilization are relied upon to proceed with their solid execution, in spite of the fact that these will be progressively kept down by quickening expansion and work deficiencies.

While unemployment is consistently diminishing, work development is getting to be compelled by the falling work supply. Driven by the contracting work compel and, to some degree, monetary development, the joblessness rate kept on declining to 8.7 % in 2017. A quickly rising number of opening, announced work deficiencies and a solid increment in compensation flag a fixing of the work advertise.

Work remained for all intents and purposes unaltered while wage development kept on expanding further, coming to about 10% in the initial seventy five percent of 2017, additionally mostly because of an expansion in the lowest pay permitted by law.

Key sectors in Latvia

Latvia offers potential investment opportunities for foreign investments in the following sectors:

- Woodworking

- Metalworking and mechanical engineering

- Transport and storage

- Information technology (including global business services)

- Green technology

- Health care

- Life sciences

- Food processing

Environmental Technology

Experienced in sustainable power source age, Latvia gives an incredible situation to efficient power vitality ventures. Latvian government has made a vital arrangement for sustainable power source part with the most noteworthy objectives among EU part states for 2020, adding to the possibility to extend this segment.

The part is outfitted with talented work, long-standing knowledge and the fundamental assets. Latvia’s endeavors to enhance vitality productivity and expanding enrolment in degree courses applicable to the area additionally add to the business’ potential.

Key favorable circumstances:

- Endeavors to diminish vitality reliance on Russia

- Long-standing background and mastery in the age of vitality from inexhaustible sources

- Most reduced vitality power in industry

- Wealth of common assets

- Expanding enrolment figures in degree programs pertinent to the segment

Primary Sectors of Industry

Four cornerstones of the Latvian economy are agriculture, chemicals, logistics and woodworking.

Agribusiness appreciates the rich soil and calm atmosphere of Latvia. It is the customary exchange of Latvians is as yet pertinent today. Grain makes up 33% of the area. Quality dairy items and honey lead the specialty of high included esteem sends out.

Synthetic industry depends on very instructed HR. Drug store, reusing, eco-accommodating chemicals and bio beauty care products are fabricated in Latvia and broadly traded abroad. College instructed neighborhood specialists give creative crucial innovative work (as in the Institute of Organic Synthesis).

Therapeutic revelations are among the features of the Latvian compound industry.

Coordinations is entrenched since time immemorial because of the geographic area of Latvia. Ports, rail and streets of Latvia have constantly connected Europe and whatever remains of the West with the East. 25 million clients are reachable inside 48 hours in the Baltic locale by Latvia. Air terminal of Rīga gives European and cross-country flights to right around a hundred goals.

Carpentry blossoms with the green gold of Latvia. Half of the nation is secured by rich forests, some of which are cut and sent out. Raw timber and fabricated items are a prominent part of Latvian fares. Assigned normal stores, state possessed backwoods and long haul business techniques keep the harmony amongst business and nature.

Metalworking and Mechanical Engineering

Metal preparing and building has verifiably been one of the main modern parts in Latvia, as the nation was one of the innovative assembling habitats for Soviet military and aviation enterprises. Key points of interest of the segment incorporate its talented and cost-productive workforce, solid R&D ability, access to metal supplies from Russia and closeness to business sectors in the east and west.

Key Advantages

- Customarily one of driving segments

- Simple access to crude materials because of a profitable geographic area

- Amazing coordinations foundation

- Aggressive work drive

- High aggressiveness in higher esteem items

- Move towards more complex creation

Metalworking and Mechanical Engineering have customarily assumed a vital part in Latvia’s economy, today representing 27% (2015) of Latvia’s aggregate fares. Latvia was the cutting edge fabricating community for Soviet-time military and aviation ventures.

Henceforth Latvia’s R&D capacity and high instructive standard of the segment’s workforce result from long-standing background.

Food Processing

The food and drink processing area gives speculators a full scope of chances for progress, including a vigorous production network, an accomplished workforce and top notch measures. Household makers can likewise viably track nature of their items, from fixings, through creation and travel, to showcase— empowering generation of crisp and common nourishments that shoppers look for.

Key Advantages

- Hearty store network

- Access to quality fixings

- Biological horticulture for common fixings

- Plenitude of talented and aggressive work

- Industry benchmarks and supportability

- Created travel framework

Food and refreshment generation is the biggest modern area in Latvia. The sustenance business segment delivered around 23.5% of the aggregate yield in assembling (2015). Just about 20% of Latvia’s region is arable land, and most fixings are privately developed—giving makers a strong and proficient production network.

Makers have a wide scope of local providers to look over, empowering sound rivalry as far as cost and quality.

Household food and drink producers can adequately track nature of their items from field to table, giving them an edge in the worldwide commercial center— particularly as customers overall turn out to be progressively aware of sustenance fixings.

Taxes in Latvia

Under the new CIT, all undistributed corporate benefits are charge absolved.

This exclusion covers both dynamic (e.g. exchanging) and aloof (e.g. profits, intrigue, eminences) sorts of wage. It likewise covers capital increases from the offer of a wide range of advantages, including offers and securities, aside from offer of steady property by non-occupants.

This duty administration is accessible to Latvian occupant organizations and perpetual foundations (PEs) of non-inhabitant organizations that are enrolled in Latvia.

The tax assessment of corporate benefits is deferred until the point that the benefits are dispersed as profits or regarded to be conveyed. Profit distribution:

- Dividends (including interim dividends)

- Payments equal to dividends (i.e. profit share-outs by [a] cooperative societies, [b] sole traders, [c] partnerships, and [d]

- PEs). Deemed dividends (i.e. part of earnings being added to share capital)

Deemed distribution:

- Non-business expenses

- Doubtful debts

- Excess interest payments

- Loans to related parties (with several exemptions)

- Transfer pricing adjustments

- Surplus assets on liquidation

- Benefits a non-resident gives to employees of its PE

Micro-business tax (MBT)

The Micro-business Tax Act gives existing and newly-formed businesses the opportunity of acquiring micro-business status and registering for MBT if they meet the following criteria:

- The shareholders are individuals

- The turnover does not exceed EUR 40,000 in a calendar year

- The number of employees does not exceed five at any time

- An employee can be employed only in one MBT

- Members of the board are concurrently employees of the MBT payer

- Remuneration of each MBT payer employee does not exceed EUR 720 per month

- The standard MBT rate is based on a micro-business’s turnover up to EUR 40,000, and covers payroll taxes, business risk duties, and CIT

Turnover till EUR 40,000 is subject to MBT at 15%.

The standard rate may be increased in the following cases:

- If its quarterly staff count exceeds five, then 2% per extra employee will be added to the standard rate

- If an employee is employed in more than one MBT, then 2% per extra employee will be added to the standard rate • If the turnover exceeds EUR 40,000 in a calendar year, the excess will attract a rate of 20%

- If an employee’s net income exceeds EUR 720 a month, the excess will also attract a rate of 20%

There is no additional rate of MBT where a citizen has detailed a relentless income development rate in the monetary explanations in the course of the last two duty years, topped at 30% every year. Comparative principles apply to a smaller scale business`s headcount development, capped at one to two workers for each year.

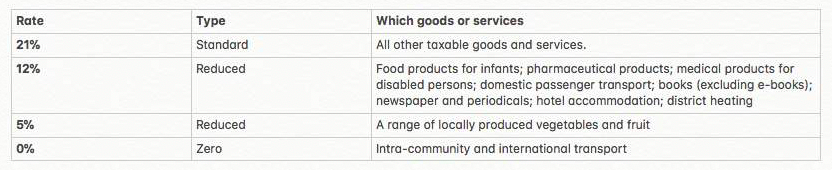

Value-added tax (VAT)

Latvian VAT compliance

Once in posses Latvian VAT, you will have to start following the local rules, like:

- Issuing invoices with the disclosure details outlined in the Latvian VAT Act

- Electronic invoices with proper signature, authenticity and agreement by the recipient

- Maintenance of accounts of record, which must be held for at least 10 years

- Correct invoicing of customers for goods or services in accordance with the Latvian time of supply VAT rules

- Processing of credit notes and other corrections

- Use of approved foreign currency rates

Investing in Latvia

Foreigners are allowed to invest in Latvia. As a small country it welcomes foreign investment, and as a member of Nasdaq/OMX, it is easy for foreigners to invest in local equities and bonds.

In the past, privatization was the main source of FDI for the country. Nowadays, a significant portion of FDI comes from re-investments and classic merger/ acquisition operations.

The main foreign investments were made in the telecommunications, oil pipelines, real estate, retailing and banking sectors. After solid yearly development rates since its increase to the EU, the load of remote direct venture (FDI) in Latvia diminished amid the worldwide emergency.

In 2015, FDI inflows continued a positive pattern with USD 643 million.The general stocks sum for USD 14,549 million of every 2015.

The principle outside financial specialists in Latvia are Estonia, Russia and the Scandinavian nations, speaking to around 33% of all FDI, and in addition Denmark and Germany. The EU represents 13.8% of gross settled capital arrangement in 2015.

Strong Points

The country’s main strong points are:

– A skilled and inexpensive workforce

– Legislation that is harmonized with the European Union and favorable to investments

– A simple and attractive taxation system

– The presence of strategic transit and logistics centers

– High productivity

– Low taxes and

– A strategic geographical location, which allow access to Russia and to the former Soviet republics

Weak Points

The country’s main weaknesses are:

– The limited size of its domestic market;

– The low numbers of foreign companies in the country;

– Economic instability and high market fluctuations. In this regard, the economic crisis, which Latvia is currently going through has shown the country’s limitations, which remain subject to political and social instability and whose economy could deteriorate rapidly.

Government Measures to Motivate or Restrict FDI

Following its independence, Latvia decided to launch itself in the market economy and to acquire the capital it was lacking. It therefore progressively opened itself up to direct foreign investments. In order to attract foreign companies, the Latvian government offers financial assistance. Its strategy is especially to promote the high technology industrial sector.

The different funding enable the quality of services to be improved. A loan and semi-loan plan has also been launched to promote SMEs.