Iran is a sovereign state in Western Asia. It is bordered to the northwest by Armenia, the de facto independent Nagorno-Karabakh Republic, the Republic of Azerbaijan, and the exclave of Nakhchivan; to the north by the Caspian Sea; to the northeast by Turkmenistan; to the east by Afghanistan and Pakistan; to the south by the Persian Gulf and the Gulf of Oman; and to the west by Turkey and Iraq. With over 79.92 million inhabitants Iran is the world’s 18th-most-populous country.

Iran’s intrusive state and institutional shortcomings continue to hold back more broadly based economic development. Deriving most of its revenue from the oil sector, the state owns and directly operates numerous enterprises and indirectly controls many companies affiliated with the security forces. The rule of law remains vulnerable to political interference and oppression.

Iran is the second largest economy in the Middle East and North Africa (MENA) region after Saudi Arabia, with an estimated Gross Domestic Product (GDP) in 2016 of US$412.2 billion. It also has the second largest population of the region after Egypt, with an estimated 78.8 million people in 2015.

Iran’s economy is characterized by the hydrocarbon sector, agriculture and services sectors, and a noticeable state presence in manufacturing and financial services. Iran ranks second in the world in natural gas reserves and fourth in proven crude oil reserves. Economic activity and government revenues still depend to a large extent on oil revenues and therefore remain volatile.

Iranian authorities have adopted a comprehensive strategy encompassing market-based reforms as reflected in the government’s 20-year vision document and the sixth five-year development plan for the 2016-2021 period. The sixth five-year development plan is comprised of three pillars, namely, the development of a resilient economy, progress in science and technology, and the promotion of cultural excellence.

On the economic front, the development plan envisages an annual economic growth rate of 8 percent and reforms of state-owned enterprises, the financial and banking sector, and the allocation and management of oil revenues among the main priorities of the government during the five-year period.

The Iranian government has implemented a major reform of its subsidy program on key staples such as petroleum products, water, electricity and bread, which has resulted in a moderate improvement in the efficiency of expenditures and economic activities.

The overall indirect subsidies, which were estimated to be equivalent to 27 percent of GDP in 2007/2008 (approximately US$77.2 billion), have been replaced by a direct cash transfer program to Iranian households. The second phase of the subsidy reform plan began in Spring of 2014 which involves a more gradual fuel price adjustment than previously envisaged and the greater targeting of cash transfers to low-income households.

Around 3 million high income households have already been removed from the cash transfer recipient list. As a result, the expenditures of the Targeted Subsidies Organization (TSO) is estimated to have declined to 3.4 percent of GDP in 2016 from 4.2 percent in 2014.

The private sector is largely marginalized by the restrictive regulatory environment and government inefficiency and mismanagement. Modest efforts to enhance the business climate have occasionally been undone to maintain the status quo. The repressive climate stifles innovation.

BACKGROUND

After the pro-Western shah was overthrown in 1979, radical Islamic forces established a theocratic government with religious authorities holding the most power.

The president, who has limited powers, is elected every four years by popular vote in a process controlled by hard-line clerics who veto candidates that threaten the regime. Current President Hassan Rouhani, elected in 2013 as a pragmatist, has tried to steer a less confrontational path in dealing with foreign powers. Iran has the world’s second-largest reserves of natural gas and fourth-largest reserves of crude oil.

The relaxation of sanctions and reintegration into the international economy as a result of the July 2015 nuclear agreement are expected to bolster foreign investment and increase trade.

Rule of law

The government has confiscated property belonging to religious minorities. The judicial system is not independent; the supreme leader directly appoints the head of the judiciary, who in turn appoints senior judges. Corruption is pervasive. The hard-line clerical establishment has gained great wealth through control of tax-exempt foundations that dominate many economic sectors.

Government size

The top personal income tax rate is 35 percent. The top corporate tax rate is 25 percent. All property transfers are subject to a standard tax. The overall tax burden equals 6.4 percent of total domestic income.

Government spending of tax and oil revenue has amounted to 15.5 percent of total output (GDP) over the past three years, and budget deficits have averaged 1.7 percent of GDP. Public debt is equivalent to 17.1 percent of GDP.

Regulatory Efficiency

The restrictive regulatory environment, exacerbated by the state’s economic planning process and excessive bureaucracy, continues to hamper private investment and production. Labor regulations are restrictive, and the labor market remains stagnant. Price controls and subsidies that date from the early years of the Islamic Revolution have been reduced in scope in recent years.

Open markets

Trade is moderately important to Iran’s economy; the value of exports and imports taken together equals 43 percent of GDP. The average applied tariff rate is 15.2 percent. International sanctions and domestic barriers limit foreign investment. Stringent government controls limit access to financing for businesses. State-owned commercial banks and specialized financial institutions account for a majority of banking-sector assets.

QUICK FACTS

- Population:

- 0 million

- GDP (PPP):

- $1.4 trillion

- 0% growth

- -0.1% 5-year compound annual growth

- $17,251 per capita

- Unemployment:

- 5%

- Inflation (CPI):

- 0%

- FDI Inflow:

- $2.0 billion

TAXATION IN IRAN

Value Added Tax (VAT) in Iran

The standard VAT rate in Iran is 9%. VATrates applied to special goods are:

- 15% on cigarettes and tobacco products

- 30% on gasoline and aircraft fuels

- 11% on fuel oil

17 types of goods and services are VAT exempt including basic food, medicines, agricultural products, financial services, immovable property and handmade carpets.

Corporate tax rate in Iran

The corporate tax rate is 25% and applies to both resident and foreign entities (except insurance enterprises and non-Iranian airline and shipping companies). Resident entities are assessed on an actual profits basis. Non-resident entities are taxed on a deemed profits basis of 10% to 40%. This means the effective tax rate is 2.5% to 10%).

Withholding taxes in Iran

There is no withholding tax on dividends paid by Iranian companies. Interest paid to a non-resident is subject to a 3% withholding tax. Royalties paid to a non-resident are subject to corporate tax on a deemed profits basis of 10% to 40%. Iran’s most recent budget removed Iran’s withholding tax on services.

Income tax in Iran

Income tax is levied at progressive rates up to 20%.

The taxing system for foreign investors in Iran:

All foreign investors doing business in Iran or deriving income from sources in Iran are subject to taxation. Depending on the type of activity the foreign investor is engaged in different taxes and exemptions are applicable, including profit tax, income tax, property tax, etc.

1. Corporate and Profit Tax:

Prior to the distribution of profits, a company must pay a flat 10% of its taxable profit as corporate tax. Additionally, the company must calculate each shareholders tax liability (25%) plus 3% municipality tax.

2. Tax on Liaison, Representative and Branch offices:

The same corporate and profit taxes will be applied to the taxable income of branches of foreign companies (contractors, consultant engineers, etc.).

3. Personal Income Tax of Local Employees

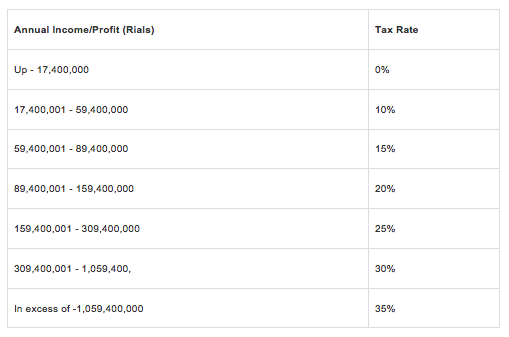

Taxable income consists of salary and benefits. As presented in the following table, income is taxed at 0-35%. Employers are required to make the necessary tax deductions from their employees’ payroll and submit them to the tax authorities. However, when calculating taxable income, exemptions and deductions are allowed. In addition to income tax, employers are required to contribute to the State Social Security Fund and the Employment Fund. The table below contains the different local and foreign income categories and their relative tax rates:

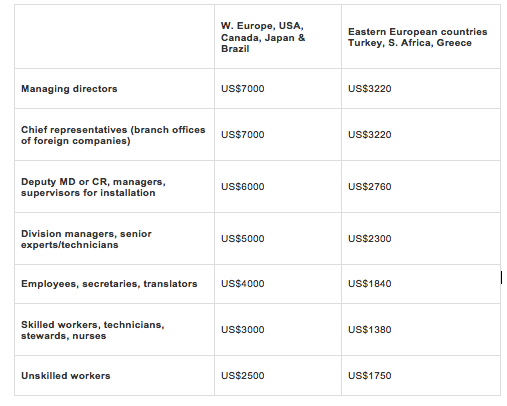

4. Personal Income Tax of Foreign Employees

Foreign nationals working in Iran are also subject to income tax based on their salary. The government assumes a certain salary for employees depending on their position and country of origin. The following table presents assumed monthly salaries and benefits of foreign nationals. The latest tax circular, issued in 1999, drastically increased the tax liability of foreign nationals working in Iran. As indicated, the assumed minimum monthly salaries range from US$2,500 for unskilled European workers to US$7,000 for European managing directors. The income of foreign nationals are subject the tax rate of 35%. The table below contains the income tax rate of the employees of two main group of the countries: